Inheritance tax planning: avoiding inheritance tax (IHT) that’s not due, is a duty to your family.

One of our obligations as citizens of a democratic society is to pay our taxes.

I doubt you or I would want to live in a land in which folk didn’t pay their taxes. Nonetheless, I’m yet to see any sense anyone paying more than their fair share – hence, inheritance tax planning.

Before we carry on, here’s a simple question: how many times would you like your family to pay inheritance tax on your assets?

It’s no trick question, so here’s the answer: ‘at most once, ideally never’.

If your answer did not have the meaning of ‘at most once, ideally never’, you might be less than serious about inheritance tax planning.

Inheritance Tax Simplified

IHT as Punishment

Inheritance tax in the UK is potential punishment on the children, grandchildren, and further generations of people who’ve done nothing to reduce, even eliminate this evil tax. Talk of visiting the sins of today’s grownups on their children and grandchildren. There’s something biblical about it.

I’ll armour your estate against the horror of inheritance tax which is a dense fog of penalties with over 251 rules, allowance and exemptions.

Inheritance Tax Planning Principles

It is only by understanding the principle of inheritance tax that we can avoid it.

Everything you might have heard about inheritance tax, especially avoiding inheritance tax is half-baked, and it ignores the fundamental point that sooner or later – we all hope later, but sooner or later, every one of us would die.

Further on this page, I’ll explain the fundamental misconception to every possible solution to inheritance tax you might heard. The key is to act now.

Every Family Has An Inheritance Tax Problem

Every family has an inheritance tax problem.

Anyone who understands the principles of inheritance tax understands this venal tax is a matter of when rather than a question of if.

For want of a less hackney phrase, one size would not fit all. The level and type of planning you require depends on the nature and composition of your family and of your assets.

With bespoke inheritance tax planning, I’ll help you master the principle of IHT, then help you avoid the wretched tax.

I’ll as your inheritance tax specialist help you answer the greatest and gravest question that could ever come before your consideration: all your assets, the fruit of your life’s work, your estate… how many times would you like your family to pay inheritance tax on your estate?

If your answer is ‘at most once, but ideally never’, you’ve come to the right place. – you have an inheritance tax expert would help you breathe life to your answer to this question.

Inheritance Tax – The One Million Pound Con

You might have heard ‘they’ve increase inheritance tax allowance to a million pounds’, but that’s sophistry, that’s a half truth, that’s the million-pound trick.

Inheritance Tax, Tactics

You might have heard of spousal exemption; it presupposes your spouse would live forever. You’ve heard of ‘gifting’; ‘the 7-year rule’; ‘the 10% threshold’; the small gift exemption and several other wheezes and schemes. These are mere tactics to avoiding inheritance tax. Inheritance tax planning uses these tactics and many more to ensure you pay as little of this nasty tax as possible.

The redundancy of stating this is almost embarrassing: naturally you know the difference between tactics, which is how you win a battle, and strategy, which is how you win a battle.

Your overcoming this nasty ailment of inheritance tax requires a strategy. A strategy crafted specifically to suit your family and financial situation.

How to Avoid Inheritance Tax

This duty to your family requires strategy as well as tactics.

The Treasury thought things were too simple, with the ‘nil rate band’ so they introduced its bastard cousin, the ‘residential nil rate band’.

The sure, easy and thorough way to avoid inheritance tax is to understand it.

Forget the Half-Truths

All what you might have heard about avoiding inheritance tax are half-truths, and a half-truth is a whole lie. So, forget all what you’ve heard previously.

The majority of them are based on a deliberate, mischievous misconception of human life.

Majority of what you’ve heard deliberately forget on thing I know above all else, that sooner or later, you, all the beneficiaries you had in mind would die. Therefore, most of what you’ve heard about avoiding inheritance tax would merely transfer the problem to the next generation.

Master The Loopholes

Understand how the over 251 allowances, exemptions and loopholes relate to you, which ones are available to you, which ones are applicable to you. Also, understand how you can protect any businesses or business interests you may have with inheritance tax planning designed specifically for you.

Understand the Principles

Understand how to interpret the rules and principles of inheritance tax to suit your family and financial circumstances so that we minimize, and often reduce to zero, the inheritance tax bill on your life’s work.

Answer the Central Question

The central question of inheritance tax is: ‘How many times would you want your descendants to pay inheritance tax on the property in which you live now?’.

If your answer is: ‘Ideally never, but at worst once.’, fill the contact form and I’ll help you banish this accursed tax.

If not now, when?

What are you waiting for?

The sooner you put your plans in place, the better chance you would of keeping your wealth in your family.

With the forest of rules, the thicket of exemptions and the jungle of allowances, you see avoiding inheritance tax isn’t a one size fits all proposition.

Minimizing inheritance tax is a serious enterprise.

Mitigating Inheritance tax requires a plan constructed specifically for your family and financial future. The first step in this plan would be arranging a free, no-obligations consultation at which you’d articulate your wishes and desires and then get a good grasp of the options of preserving your family’s wealth.

Other Things I Can Help You With

My Approach to Inheritance Tax Planning

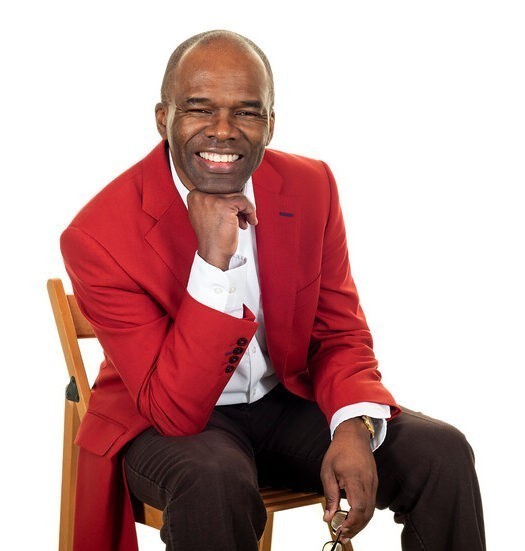

You’ve seen several reviews and recommendations – they reflect the care, diligence and experience I invest in my clients.

Your family’s unique, therefore your inheritance tax planning should be unique, no off-the-peg nonsense.

You’re the expert on your family’s matters – every family is special in its own way, therefore I’ll bend my extensive experience to your situation. I can see round corners, so I can spot possible problems and prevent them before they hatch. Before they become a nest of vipers to harm your family’s financial wellbeing.

A proud sole inheritance tax planning practitioner, I start every inheritance tax planning assignment with a blank sheet of paper. I write all my planning documents by hand, no cut and paste. No forms, no tick-boxes, no templates. No cut-and-paste. I start every relationship with a blank sheet of paper.

A central tenet of my practice is this: if you bother about maximising the amount you leave to your children, then you’re just as concerned with the amount you leave to your grand-children, your great-grandchildren and even further generations of your family.

Otherwise, I’d have lived all my years in vain.

The question, once again, is a very simple one: how many times would you like your family to pay inheritance tax on your assets?

Contact

020 8669 1779

18, Salisbury House, 8 Melbourne Rd, Wallington SM6 8SA